Mar 18, 2020 by Mark Dingley

Source: https://www.ft.com/content/318ae26c-6733-11ea-800d-da70cff6e4d3

Already 1 in 6 Australian businesses have been affected by the coronavirus (COVID-19), according to the latest Roy Morgan survey.

Around two-fifths of manufacturers report being affected, closely followed by a third of education and training businesses, and businesses in the wholesale industry.

At the top of the list for many Australian manufacturers is the issue of imports and exports. Just over a month ago, we published an article on what the coronavirus means for the supply chain.

Things have shifted substantially since then – and not in a good way.

Make no mistake, the disruptions to imports and exports is profound.

Let’s take a look at the implications as they stand today:

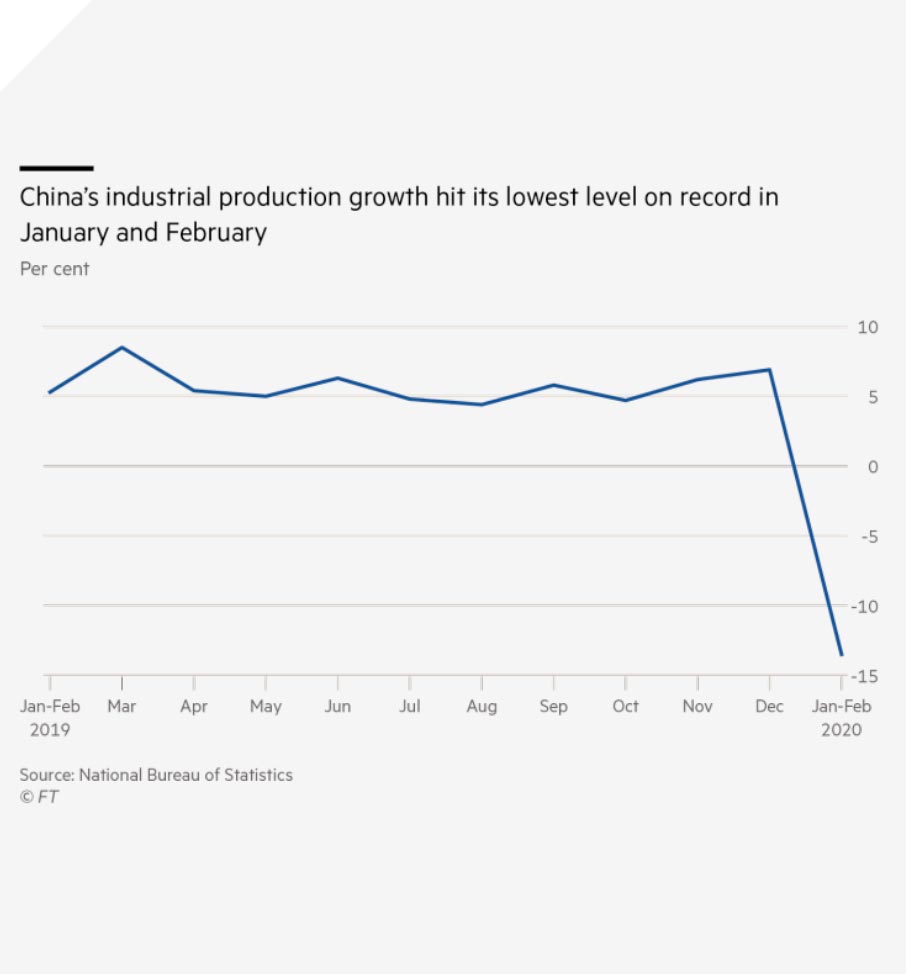

China’s exports have plummeted. The country’s overall exports contracted by 17.2% in dollar terms in the first two months of 2020, which is more than expected by economists polled by Bloomberg.

In the same period, the country’s industrial output contracted at the fastest pace ever, and in February, urban unemployment hit its highest rate on record.

The coronavirus has literally brought the world’s second-largest economy to a standstill.

For Australian manufacturers, this brings some major practical implications. One of these is that new equipment and parts are stuck in China. So, if machinery breaks down, manufacturers are facing long wait times for parts, which means expensive downtime. Also, materials and supplies are severely delayed due to supply chain hold-ups.

As a result, Australian manufacturers are finding they are unable to produce goods at their normal capacity, have to deal with long wait times, or not deliver on contracts.

Here’s what businesses told the Roy Morgan survey:

What about the rest of the world?

Italy is Australia’s 16th largest import-export destination, worth AUD$6.6 billion as of 2016.

The good news is that, as yet, Italy’s lockdown has not impacted flow of food from Italy to Australia. But it is likely to in the near future.

It’s not only imports that are impacted. Australian exporters are facing strict quarantine measures, delays throughout the supply chain, and lack of freight options. As one business told the Roy Morgan, there’s been a ‘Loss of export market to China’, while another admitted that ‘Wool exports to China have dropped off a bit’.

The Australian wine industry was already suffering a downturn in wine sales and export volumes in 2019, due trade tensions between the US and China, Brexit negotiations and trade agreement negotiations.

According to Rabobank senior wine industry analyst Hayden Higgins, COVID-19 adds to this in 2020.

“A major element affecting the global wine industry in recent months has been stagnant domestic demand in the United States, but now we are also seeing a shut-down in China due to the COVID-19 outbreak which is adding to the slowdown in Chinese wine imports experienced in 2019.”

“The coronavirus outbreak is not only affecting actual consumption and trade flows of all goods, including wine, at the moment, but its economic consequences may undermine demand for wine even after the disease subsides.”

Another more vulnerable industry is electronics. For example, Apple recently lowered its forecast revenues and missed schedules for making a more affordable iPhone after its key suppliers in China were hit.

Suppliers could also struggle to obtain certain packaging from China. Some food packaging is made from Polyethylene terephthalate (PET), of which China accounts for about 30% of global production. The rest of Asia makes up 21%.

Ritchies Supa IGA chief executive Fred Harrison told The Sydney Morning Herald that suppliers are getting short on their wrappings or biscuit trays, which could affect 76 IGA supermarkets across Australia's east coast.

Australia Post is inevitably experiencing international delivery delays due to the coronavirus. On its website, Australia Post says it is working with partner airlines and other postal operators to move items “as quickly as possible”.

However, delays may occur in ALL destination countries.The known delivery delays are to and from the following areas: China, Hong Kong, Macau, Mongolia, Israel, Italy, Jordan, Korea, Kuwait, Saudi Arabia and Spain. Australia Post maintains an up-to-date list of country specific information.

With all the restrictions around the world, is it possible for Australian manufacturers and producers to export goods overseas?

For one producer, the answer is yes.

Kilcoy Global Foods (KGF) was able to overcome China's vessel shipping restrictions caused by the coronavirus outbreak to export 2 million worth of fresh beef products to China.

How did they do it? The producer-exporter, based on the Sunshine Coast, used a 747 chartered flight from Sydney for Shanghai. It’s likely they are one of the only meat companies in Australia able to continue its beef supply to China in the midst of the global pandemic.

If you’re struggling to get supplies and materials in time, look to new geographical regions for manufacturing partners. The severity of the impact on your business will be how reliant you are on Chinese suppliers, or other overseas suppliers..

Can’t meet demand and get deliveries on time? Tell your customers. In this time of crisis, people appreciate honesty and openness.

The Federal and State Governments are rolling out financial packages to help businesses. Keep on top of the latest grants and subsidies available for producers, manufacturers and suppliers.

For example, Queensland agribusiness exporters that have been directly affected by the outbreak of coronavirus disease (COVID-19) will have access to an industry grants package of up to $50,000. Grants will be available to support agriculture, food and fishing exporters, their critical supply chain partners and industry organisations. Find out more

There’s also a wage subsidy package available for small businesses that employ less than 20 full time employees.

These are unpredictable times. We don’t know where things will go in the next few weeks, let alone months. The best thing you can do is brace yourself for uncertainty and plan for the worst.

Think about the rock lobster producers in South Australia. When the coronavirus erupted in China and authorities shut down its live seafood import trade, the industry suffered massive losses. But now, there are signs that restaurants in China will start to reopen and exports may recover.